The Federal Housing Finance Agency (FHFA) has announced the new conforming loan limits for 2025, and it’s great news for anyone looking to finance their dream home with a conventional loan. These updates reflect the growing housing market and ensure more opportunities for you to access competitive loan options. Let’s break down what this means and how it can benefit you.

What Are Conforming Loan Limits?

Conforming loan limits are the maximum loan amounts eligible for purchase by Fannie Mae and Freddie Mac. These limits vary based on the number of units in a property and whether the home is located in a high-cost area. Essentially, they determine the size of the loan that qualifies for conventional financing.

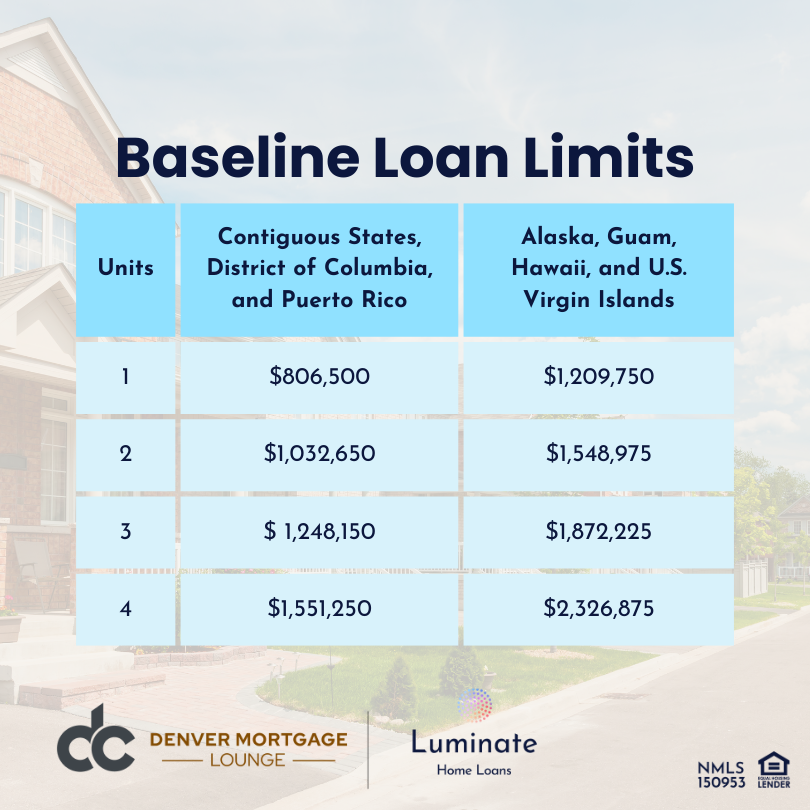

The 2025 Loan Limits at a Glance

For 2025, the baseline loan limits have increased, making it easier for you to borrow more under conventional loan terms. Here are the new limits:

To check if your area qualifies as high-cost, use tools like Fannie Mae’s Loan Limit Lookup Tool.

Why This Matters to You

With these higher limits, you may be able to:

- Purchase a larger home or one in a more competitive market without needing a jumbo loan.

- Refinance a high-cost mortgage into a conforming loan with potentially better terms.

- Take advantage of lower down payment options available with conventional loans.

These loan limits are effective for loans delivered to Fannie Mae starting January 1, 2025. Loans originated before this date may still qualify, provided they meet the 2025 limits upon delivery, so check with your lender to help you with the details.

How to Take Advantage

Navigating loan limits can be confusing, but that’s where we come in. At Luminate Home Loans, we’re here to help you understand your options and guide you toward the best financing for your situation.

Whether you’re buying your first home, upgrading to a bigger property, or refinancing, these increased limits could be a game-changer for your financial goals.

Have questions? Reach out to us today to learn how these new limits can work for you!

The post What You Need to Know About the 2025 Conforming Loan Limits appeared first on Dave Cook Mortgage Team.